Your partner for property-backed investments

The evaluation of a development project requires specific knowledge, market expertise, and relevant experience. Being professionals in our field, we offer you only selected investments, contracts drafted by lawyers and a simplified process. Investing here is clear-cut and straightforward.

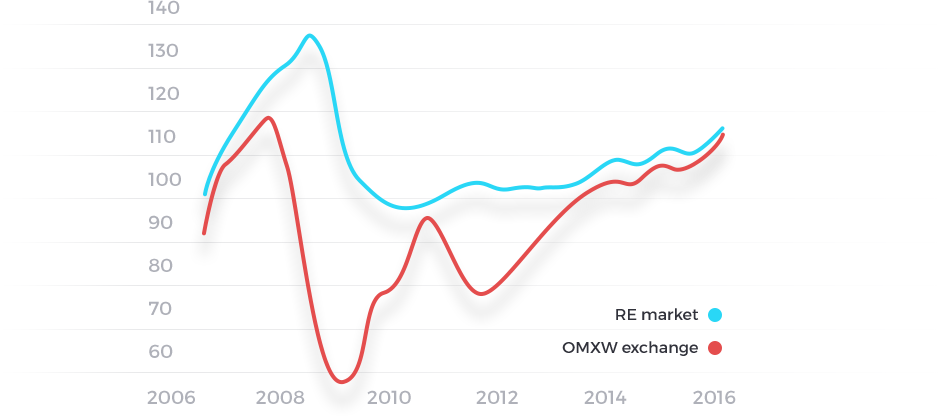

Stable investment

Return on real estate investment always depends on expected or actual lease and sales income. A transparent and straightforward cost, income structure and naturally formed demand ensure stability and maintenance of the value. This investment product is perfectly suitable for those who seek a steady return, explicit guarantees and are not willing to speculate in price fluctuations.

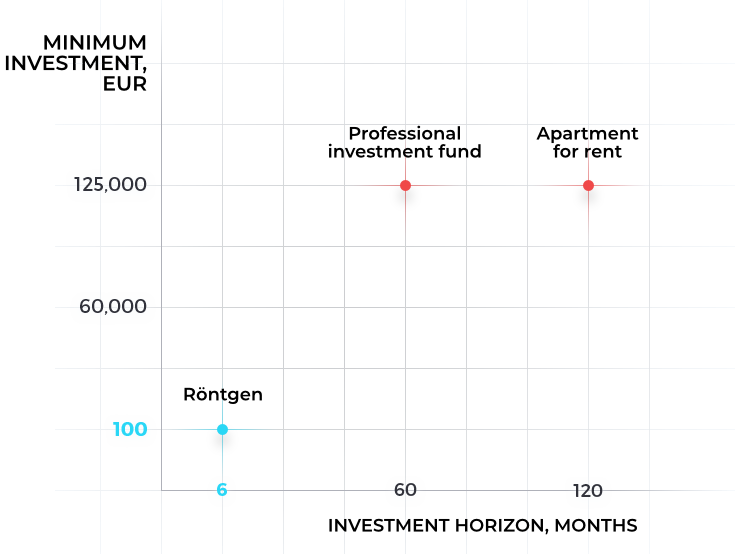

Professional product for everyone

High capital requirements and limited access to information led to a situation where real estate investments were accessible only to professional investors for a long time. By employing technologies, we break the standards and open this market to everyone. Here you will find professional solutions for ordinary people.

Investments in Lithuania into real projects

We believe that when making investments, it is essential to know and understand what the project owner will use the money for and what the end objective is. On the platform, you will find only real projects in which investments are intended for development and repayment is carried out from the sale of the project or is refinanced by the bank. During the entire project, investments are secured by the pledge of developed property.